This guide will walk you through the steps of creating a HedgeSPA account, creating a sample portfolio based on your choice of investments, and incorporating economic scenarios in order to achieve a superior combination of upside and downside returns. We begin by creating your custom portfolio. Next, we discuss how to analyze that portfolio with sample scenarios that can also be customized. Finally, we take it one step further by allowing you to test how your portfolio may perform under multiple scenarios (with probabilities specified by you) and how your portfolio may achieve superior outcomes under multiple market scenarios using advanced investment analytics.

Log into your HedgeSPA account.

If you do not have an account yet, you can sign up for a full trial of HedgeSPA by clicking here and submitting the form. An email with a verification code will be sent to you. Once you type in the code, your login credentials will be presented to you. Go back to the screen where you registered, click “go back” and log in with your credentials.

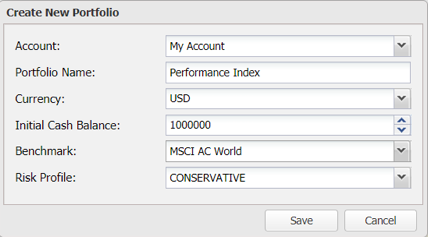

Name your portfolio and customize your preferences for the portfolio, such as Initial Cash Balance, Currency and Benchmark (the index you want to compare your portfolio to). In the example below, we will be creating a portfolio named “Performance Index” with a balance of $1 million, and comparing it with the MSCI AC World Index benchmark.

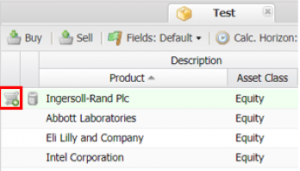

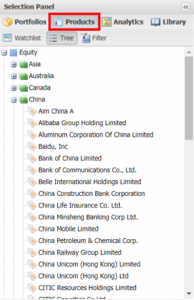

Go to Products tab under the Selection Panel. Begin to drag and drop the specific products that you want into the Portfolio Area. For each product, specify the amount of cash or number of shares to allocate towards that specific product and hit “Place Order”.

Go to Products tab under the Selection Panel. Begin to drag and drop the specific products that you want into the Portfolio Area. For each product, specify the amount of cash or number of shares to allocate towards that specific product and hit “Place Order”.

Click the shopping cart icon next to the product to confirm the order.

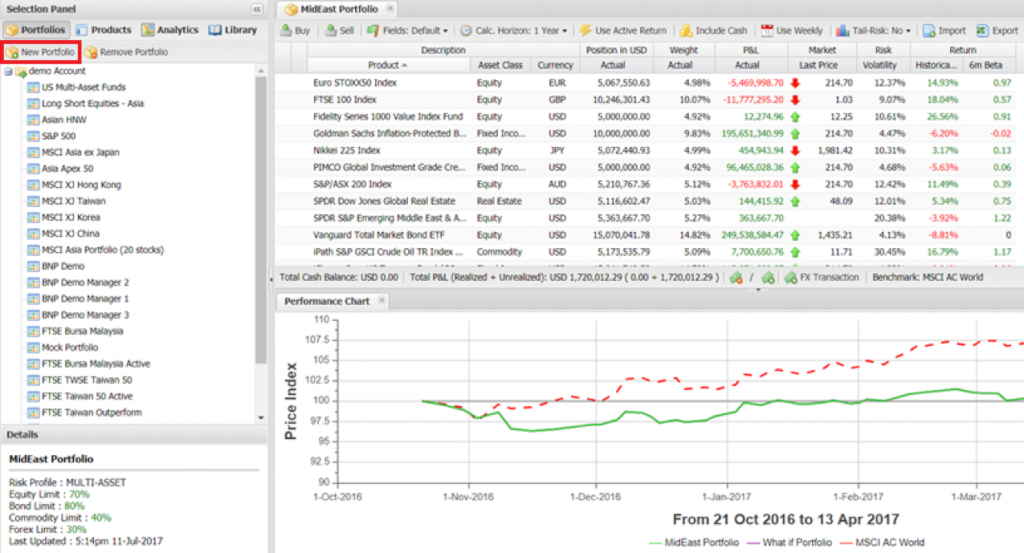

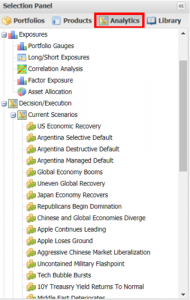

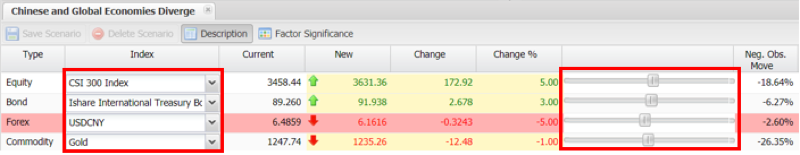

After your portfolio is completed to your liking, you may run analytics on it. To do so, access the “Analytics” tab in the selection panel. For a specific analysis to be applied to the portfolio, simply double click the one you would like to apply and it will begin to run on your portfolio. You may specify shocks on certain scenarios if you would like. For example, expand the “Current Scenarios” section under the “Analytics” tab and select a scenario of your choice. Once the scenario has been selected, you may choose the product (equity/bond/forex/commodity) to shock from the drop-down menus as well as the strength of the shock. (Note: Trial members will not be able to save custom scenarios, but this can be done with the full version).

After your portfolio is completed to your liking, you may run analytics on it. To do so, access the “Analytics” tab in the selection panel. For a specific analysis to be applied to the portfolio, simply double click the one you would like to apply and it will begin to run on your portfolio. You may specify shocks on certain scenarios if you would like. For example, expand the “Current Scenarios” section under the “Analytics” tab and select a scenario of your choice. Once the scenario has been selected, you may choose the product (equity/bond/forex/commodity) to shock from the drop-down menus as well as the strength of the shock. (Note: Trial members will not be able to save custom scenarios, but this can be done with the full version).

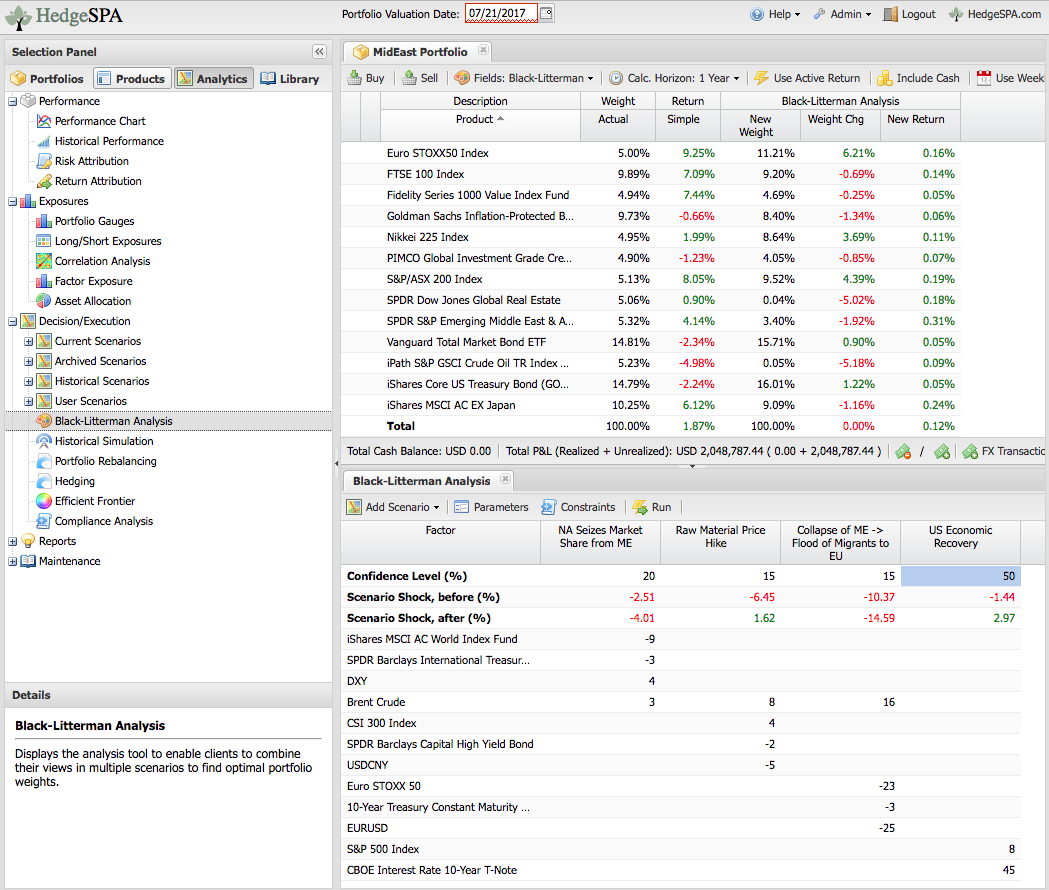

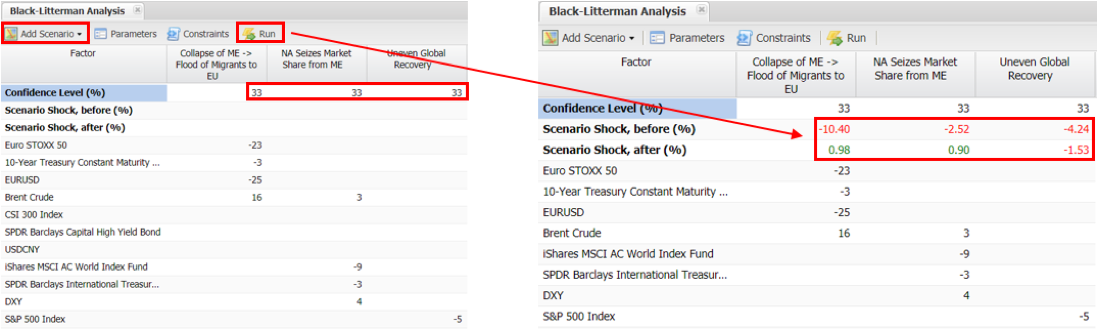

If you would like to assign custom confidence intervals and properties to multiple scenarios, you can create a Black-Litterman model. To do so, select the “Black-Litterman Analysis option under “Analytics”. Choose the scenarios you would like to add to the analysis under the “Add Scenario” option in the “Black-Litterman Analysis” tab. After choosing your scenarios, enter the confidence interval for each scenario, and click “run”.

Final Result:

We have shown how a small portfolio like the one below can be rebalanced to achieve a significantly more interesting upside (from -1.5% to 3%) and somewhat improved downside. The proposed changes in weights are executable for a typical multi-asset, absolute return portfolio as such. Even for investors who are unfamiliar with the HedgeSPA platform, the 6 steps above can be completed in about 10 to 15 minutes. Similar analytics used to be risky, expensive and resource intensive in-house development projects, but our cloud-based solution let professional investors share that cost and avoid reinventing the wheel – thus our mission to democratize access to advanced investment analytics for all professional investors.