Syrian Rubble (Source: Wikimedia Commons; Labeled for Reuse with Modification)

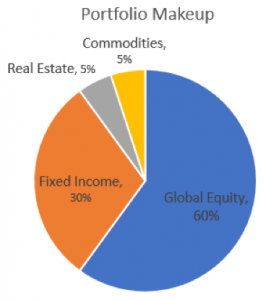

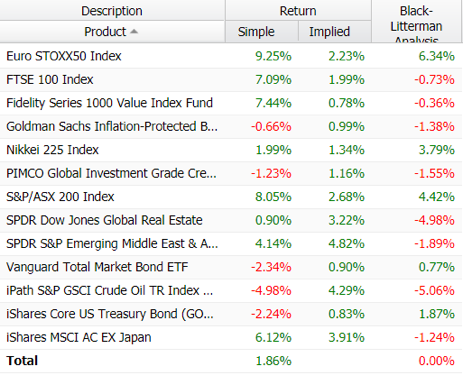

This article will discuss the safeguards a multi-asset portfolio manager can implement to better protect their investments against potential market shocks due to increased tensions in the Middle East. HedgeSPA has created a simplified portfolio (see below) representing the typical allocation of a multi-asset absolute return portfolio, consisting of 60% global equity, 30% fixed income, 5% real estate, and 5% commodities. This distribution is consistent with typical allocations maintained by our users. We consider three possible scenarios with increased Middle East tensions: The first would result in North America seizing oil production market share from the Middle East after an increase in market volatility. The second scenario examines a rise in the prices of petroleum byproducts, resulting in increased manufacturer production costs and global supply chain price hikes. The final, most extreme scenario involves mass immigration by economic migrants from a war-torn Middle East into Europe, accelerating its role as a catalyst towards an eventual breakup of the European Union.

Geopolitical Background

Since the second half of the 20th century, the Middle East has seen an unprecedented level of conflicts that has created immense human, physical, and economic costs. For example, the Iraq War alone has cost the United States more than two trillion dollars. More recently, events such as American military forces downing an Iranian-made Syrian drone and ISIS destroying a Mosul mosque have shown that tensions are rising instead of subsiding in the Middle East.

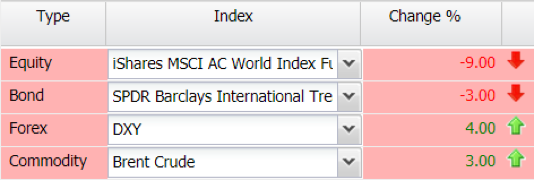

The Middle East is the largest exporting region for some of the world’s most consumed raw materials, such as natural gas, crude oil, and other petroleum products; however, the recent rise of ‘fracking’ has greatly increased the size of potential American and Canadian oil reserves. A rise in conflict within the Middle East would cause spikes in oil prices, often followed by drops shortly afterwards. Importers of Middle Eastern oil will eventually become wary of price volatility and logistical concerns, which could result in a meaningful amount of oil production being replaced by North American producers that are keen to secure stable revenues. All in all, this scenario would be the least devastating for the global economy.

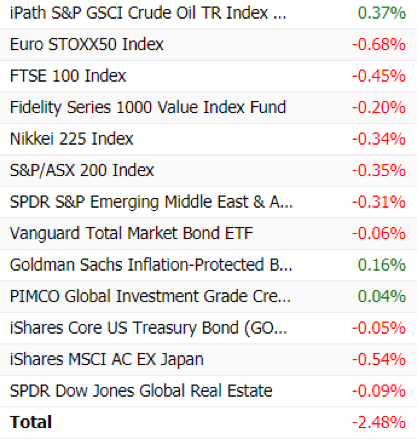

The second possible outcome branches off the first. Continued volatility of export prices concerning the byproducts of petroleum could affect major goods manufacturers, such as those found in China, which maintains profit margins as low as <2% to keep wholesale costs cheap. If export prices were to increase then manufacturers would in turn raise their prices, which will affect all markets after them in the global supply chain, ultimately hurting consumers (especially those in the West). The subsequent cost of living increase will effectively lower purchasing power parity within Western markets. In summary, under this scenario the center of gravity in the world economy would move closer to China and emerging markets, which are expected to gain a bigger share of the total pie due to their domination of the manufacturing sector, while the aging economies in the Americas, Europe and developed Asia could fall into a slump.

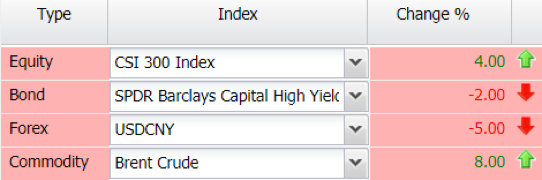

The third outcome can be considered a worst-case scenario. If the severity of conflict within the Middle East reaches a tipping point, it could cause a key western ally such as Jordan to be overtaken by radical operatives, resulting in even more instability in the region. In the past, this has been known to create a flood of economic migrants into Europe, which could encourage the election of nationalist parties, with a common agenda of dismantling the existing geopolitical order in a style similar to Britain’s exit from the European Union. Even if just one major European country drops out of the EU, operating and borrowing costs for businesses in the region will increase further, hindering commercial activities and ultimately leaving Europe and the Middle East in prolonged political and economic uncertainty.

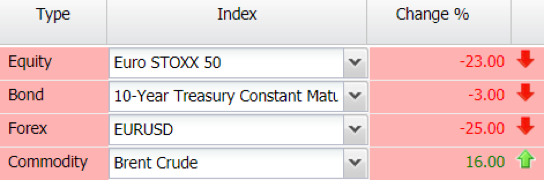

We should start by noting that downside scenarios should not be the only economic outcome. Keeping this in mind, we will assume equal confidence levels at a 50/50 split to upside and downside scenarios. The upside scenario we will be using involves the United States experiencing continued economic recovery with rising interest rates, which is a common market assumption in the absence of major conflicts. Next, the three scenarios discussed in this article will make up the downside. We have placed these four scenarios into our implementation of the Black-Litterman model for further analysis:

Aside from more extreme cases, such as the outcome leading to the possible breaking up of the European Union, the portfolio produces better expected returns in all scenarios, including the upside scenario. This shows that while this portfolio may not be the best option for, say, a retiree’s safety-first pension fund, it would be very well-suited for an institutional investor interested in general improvements under most reasonable upside and downside scenarios. Some recommended improvements would be to reduce exposure to alternative investments (in particular crude oil) and increase allocation into economies that would generally benefit from a rise in oil price, such as Australia. These recommendations are generally consistent with what most fundamental investors may do. With these analytics tools, investment professionals can add scientific rigor to their portfolio re-balancing decisions to benefit end investors.

Aside from more extreme cases, such as the outcome leading to the possible breaking up of the European Union, the portfolio produces better expected returns in all scenarios, including the upside scenario. This shows that while this portfolio may not be the best option for, say, a retiree’s safety-first pension fund, it would be very well-suited for an institutional investor interested in general improvements under most reasonable upside and downside scenarios. Some recommended improvements would be to reduce exposure to alternative investments (in particular crude oil) and increase allocation into economies that would generally benefit from a rise in oil price, such as Australia. These recommendations are generally consistent with what most fundamental investors may do. With these analytics tools, investment professionals can add scientific rigor to their portfolio re-balancing decisions to benefit end investors.

To see a step-by-step walk-through on how we came up with these portfolio recommendations and how the same analysis can be applied to your portfolio, visit hedgespa.com. You can also contact help@hedgespa.com for further details.