Tapering On the Horizon?

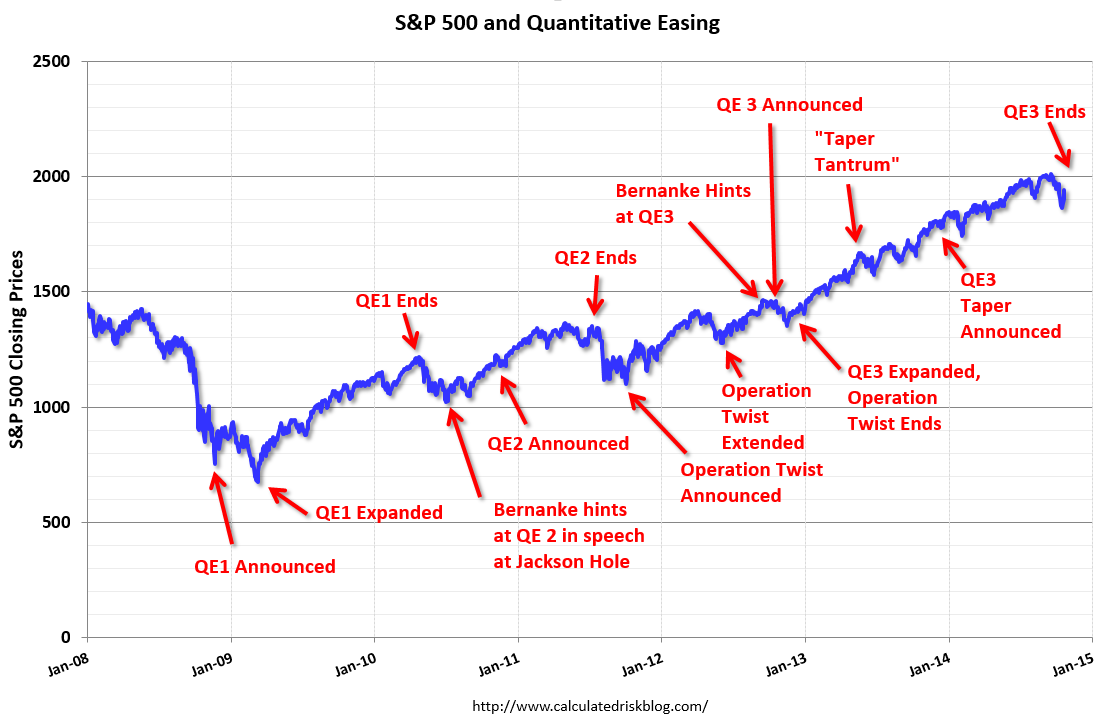

As an eventful 2013 comes to a close, investor mailboxes are rapidly filling with advisor market forecasts for 2014 focusing on the future of the United States QE program. G4 central bank bond purchasing drove some of the main investment themes of the past year, from the Abenomics-powered run up in Japanese equities to the mid-year emerging market pullback as the US Federal Reserve discussed tapering. The expanded Bank of Japan purchases pushed total central bank bond purchases for the year to an estimated $1.6 trillion US dollars, or well more than half of 2013’s total demand for bonds. Though the Fed discussed tapering this year, QE continued uninterrupted.

The United States economy continues to show positive signs for stronger growth in 2014. November 2013 jobs numbers showed promise as the unemployment rate fell to 7 percent, job openings rose to their highest level since May 2008 and the number of people quitting their jobs reached a level last seen in October 2008. At the same time, bi-partisan Congressional budget negotiators have reached a deal that may help the country avoid another costly standoff and shutdown. Most signs appear to point to a reduction in Fed bond purchases in the first half of 2014.

Given this perceived strength and recent discussions of asset price bubbles, the big question on many investors mind is: Exactly how soon will the Federal Reserve begin to taper QE, and how will that impact my portfolio?

1. Winter with the FOMC – January Taper

The recent series of strong US fundamental indicators has market participants wary the Fed may begin tapering sooner than they’d originally expected. St. Louis Fed president James Bullard openly discussed the possibility of a “small taper” for the December 2013 FOMC meeting while Dallas president Richard Fisher called for a move “at the earliest opportunity.” Though many of the voting Fed members still seem to favor tapering in the new year, further signs of economic strength could lead to a January or even December tapering announcement.

Any reduction in Federal Reserve Treasury purchases will quickly push bond yields higher. US equity markets are likely to continue to climb on the back of the same strong economic fundamentals used to justify the Fed’s move, while European and Japanese equities continue to benefit from those regions’ accommodative monetary policy. With those central banks continuing to buy bonds as the US slows purchasing, the US dollar will begin to strengthen back to pre-crisis levels. New investments in energy will continue to add the burgeoning supply, exerting negative pressure on oil prices.

2. Yellen’s Spring Cleaning – March Taper

In spite of recent strong economic numbers, industry economist surveys generally point to the March FOMC meeting as the most probable time for the Fed to begin tapering. Many market watchers believe the FOMC will not begin tapering before Janet Yellen succeeds Ben Bernanke as Chairman of the Federal Reserve at the end of January 2014. The jitters that drive have driven markets lower throughout 2013 whenever voting Fed members discuss any tapering provides further reason to think QE will be left in place until the March meeting.

As it becomes increasingly clear that positive US fundamentals will lead the Fed to a spring-time taper, bond yields are likely to gradually increase initially followed by larger gains once the tapering begins. US equity market gains are likely to continue, albeit at a somewhat slower pace than 2013, while a European recovery continues to take hold and yield gains. The dollar may continue to strengthen versus other developed market currencies as a reduction in US QE appears much closer than action from other central banks, while the continued shale revolution exerts pressure on oil prices.

3. BBQs and Bond Yields – June Taper

Current statements made by Fed governors are likely trial balloons designed to test the market’s reaction to the prospects of near future tapering. When Bernanke told the US Congress the Fed may begin to reduce bond purchases in May 2013, the markets reacted strongly. A notably weakening in financial markets in response to these statements could potentially combine with mixed end-of-the-year fundamental numbers to further postpone any Federal Reserve action.

Bond yields are unlikely to fall further even with Fed action postponed until the summer as market participants uniformly anticipate there will be tapering in 2014. As long as rates remain low and the leading developed market central banks continue with loose monetary policy, equity markets are likely to continue marching upwards and stoking concerns of stock bubbles in some regions. The market status quo sees a very gradual continuation in current trends, with the Yen re-gaining some of the ground lost versus the dollar earlier in the year and oil slowly sliding as supply weighs on price.

See the Scenarios Live

HedgeSPA platform users can see these scenario analysis pieces, as well as the statistical impact of these scenarios on the HedgeSPA platform. Get in touch with a HedgeSPA representative at salesnsupport@.com to find out about getting a trial account suited to your investor profile today.

HedgeSPA Research Team – 12 December, 2013

Leave A Comment

You must be logged in to post a comment.