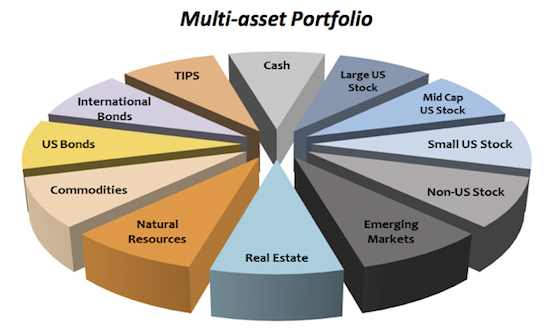

An absolute return manager helps manage a $20 billion endowment fund. His goal is to keep generating steady return, ideally in the high single digit range over the medium to long run, in order to support the fund sponsor regardless of how the market fluctuates up and down. The composite benchmark of this portfolio as approved by his sponsor’s investment committee is very similar to Harvard Management Company’s Policy Portfolio set in 2010. To implement the investment bucket to target 14% allocation in energy/commodities, he wants to know whether it is better to invest in a traded asset such as a traditional energy ETF or a non traded asset such as an oil field. See the full case and how HedgeSPA would analyze the asset below.

[pdf-embedder url=”https://www.hedgespa.com/wp-content/uploads/2014/05/Evaluating-a-Non-Traded-Asset-in-a-Multi-Asset-Portfolio-22-OCT-14-.pdf”]

Leave A Comment

You must be logged in to post a comment.