FREQUENTLY ASKED QUESTIONS

- Cost vs Benefit: Asset managers get faster time to market and cheaper access to market data & exchange connectivity.

- Reduced Compliance Efforts with our compliance-quality documentation.

- Proven Target Investor Segmenting: We help our users define digital strategies to target investor segments.

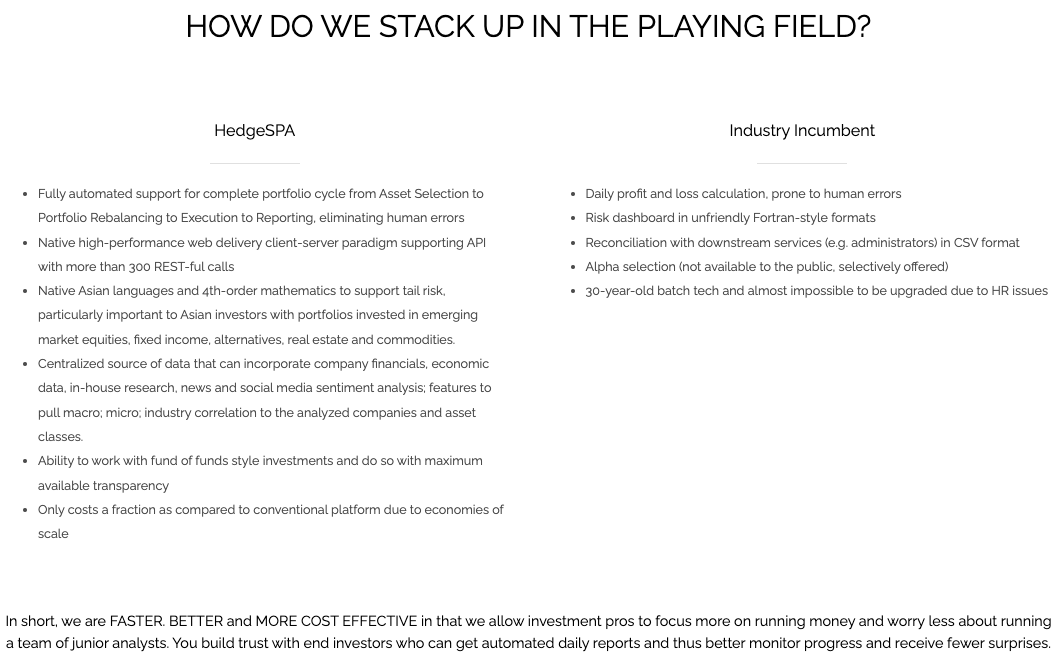

- Faster and better analytics

- for global multi-asset (stocks, bonds, real estate, alternatives, and commodities) using 4-th order mathematics

- with a true front to back system that allows easy integration with any institution

- in a user-friendly format/terminal

- to facilitate easier adherence to any compliance/regulatory rules

- with web delivery

- at a fraction of legacy system cost.

- Private Asset Managers: We work with some of the largest asset managers (some tied to insurance companies, thus the ALM angle) to build strong investment track records.

- Public Institutions: We work with government-linked institutions, pensions and central banks.

- Wealth Managers: We enhance wealth management offerings at leading private banks and External Asset Managers.

- Energy Market Participants: We work with a range of energy market participants, from mineral-wealth asset sponsors to tokenizing carbon credits.

- Asset Managers.

- Insurers.

- Pension Plans.

- Central bank or official institutions.

- Private banks.

- External Asset managers.

- Single and Multi-family offices.

- Energy trading groups.

- Alternative energy providers.